Insurance.

It’s a word that rarely sparks excitement. More often, it conjures images of complex jargon, endless paperwork, and a necessary evil we reluctantly pay for.

Just last week, my friend and I got onto the topic and she felt paralysed by the sheer number of choices out there.

I’m sharing my own plans here in the hopes that it can be a good reference point for anyone who is just starting out. Other guides I found useful are: this Reddit thread and Investment Moats’ insurance philosophy.

My current ones (in order of my own priority) are:

- Medishield Life and hospital plan with rider

- Personal accident

- Dependent Protection Scheme and term life insurance with CI and ECI

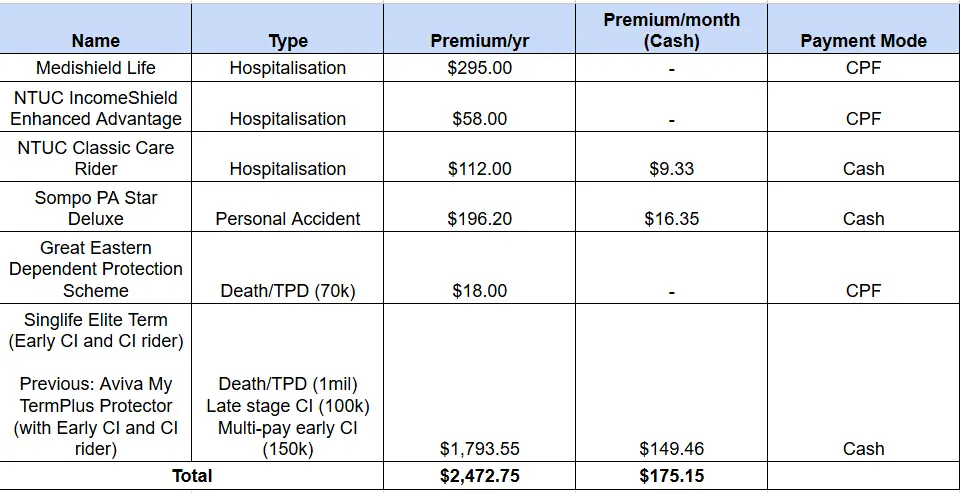

In total, I’m paying:

- Cash: SG$175.15/month (or SG$2,101.05/year)

- CPF: SG$30.92/month (or SG$371/year)

- Total: SG$206.06/month (or SG$2,472.75/year)

Here’s a closer look at the different insurance plans I have.

Hospital insurance

This is a key insurance to have!

If you have limited funds, I suggest you make the hospital plan your top priority because medical bills can easily wipe out a huge chunk of your savings. I have two insurance that cover my hospital bills:

- Medishield Life

- NTUC IncomeShield Enhanced Advantage & Classic Care Rider

Some may have the idea to simply put aside funds for hospital bills, but I personally think it’s better to outsource the risk to a 3rd party than try to save for your future hospital bills on your own, especially with rapidly rising healthcare costs year after year.

What I’d do instead is to create a sinking fund for my hospital insurance expenses (check out Investment Moats’s post about this). This is a more realistic and measurable target to save towards than an arbitrary hospital bill.

a) Medishield Life

This is Singapore’s universal health insurance, which is compulsory for all Singaporeans and PRs.

Coverage: Provides basic coverage for large hospital bills and selected costly outpatient treatments in public hospitals. Payouts are sized for subsidised treatments in B2/C wards. It has an annual limit of $200,000.

Cost: It costs SG$295/year for my age group, which is payable by Medisave, so I don’t have to fork out any cash.

b) NTUC IncomeShield Enhanced Advantage

NTUC IncomeShield Enhanced Advantage is an Integrated Shield Plan (IP), which I paired with a rider, the NTUC Classic Care Rider.

Coverage: My IP complements Medishield Life by offering coverage for public hospital wards up to A class. It provides “as charged” coverage for eligible inpatient medical services and selected outpatient hospital treatments up to the plan’s overall annual limit ($500,000 per policy year for Advantage).

Meanwhile, the Classic Care Rider significantly reduces my out-of-pocket cash payments (deductibles and co-insurance) for medical treatments, capping co-payment for panel doctors at $3,000 per policy year. This co-payment amount is comfortable for me.

Rationale: This was a plan bought by my parents, which I took over the payment for. After reading more about the policy, I feel like this standard IP is serving me well for now, though I’d like to upgrade to a private hospital IP if possible (read more below). It’s also generally not advisable to switch around your hospital plan due to possible exclusions when you’re in between plans.

Cost: My IncomeShield Advantage IP (SG$58/year) is paid from Medisave, but the Classic Care Rider requires cash (SG$112/year). Here’s a good comparison by MOH of all the other IPs available in Singapore and their premiums.

Personal accident insurance

I love my personal accident (PA) plan – Sompo PA Star Deluxe. I tapped on it once for my arm dislocation injury from climbing and it was a breeze to claim all medical expenses incurred plus my weekly income benefit!

Coverage:

- Medical expenses incurred due to an accident (e.g., doctor’s visits, X-rays, hospitalisation from an accident).

- Daily hospital income benefit if hospitalised due to an accident.

- Weekly income benefit for temporary disablement caused by an accident.

Cost: I opted for Sompo because they offer the lowest premium PA plan on the market with the coverage that I needed. I’m paying SG$196.20/year in cash.

Life insurance

Life insurance

I have two life insurance plans:

- Great Eastern’s Dependent Protection Scheme

- Singlife Elite Term (Early CI and CI rider)

a) Great Eastern’s Dependent Protection Scheme (DPS)

This is a government-initiated term life insurance scheme offered to eligible CPF members. It isn’t compulsory, but it is automatically given upon the first CPF working contribution.

Coverage: Provides basic coverage for death, terminal illness, or total permanent disability (TPD), with a sum assured of $70,000.

Cost: I’m paying SG$18/year via CPF OA for this group term life insurance.

b) SingLife Elite Term with CI & ECI

I believe in Buy Term, Invest the Rest, which I’ll go into in another post.

Despite my belief, this term life insurance is a regretful purchase at this stage of my life (maybe because I fortunately didn’t get to use it yet). I got it after one year of working. My primary rationale for buying this plan back then was to ensure a financial safety net for my parents and brother should an unforeseen event occur. The CI/ECI component was intended to cover potential expenses if I were diagnosed with a critical illness.

In hindsight, I should probably have waited till I got dependents (retired parents or kids) before buying the plan. My parents are still working, and I do have savings that they can use should I die LOL. Alternatively, if I were struck by a CI, I do have the same savings that I can tap on and also continue running my content creation business (for non-serious CI) as it’s mostly remote work.

What I would have bought instead: Given my current circumstances and if I’d like to truly optimise my insurance, I would probably buy a Big 3 Critical Illness plan covering Cancer, Heart Attack, and Stroke. These plans are more cost-effective as they focus on the statistically most common critical illnesses, providing substantial coverage where the risk is highest, without the higher premiums associated with less common conditions. Generally, the more complicated the plan is (ECI or ILP), the higher the premium is going to be.

Coverage

- Death/TPD (1mil)

- Late stage CI (100k)

- Multi-pay early CI (150k)

Cost: I’m paying $1,793.55/year via cash.

Other cancelled insurance plans

NTUC Foundation Plan: This was an old savings/term plan bought by my parents when I was a newborn. The premium was SG$1,367.25/year till 2051. In paper, I’d get a cash value of SG$16k and a non-guaranteed cash value of SG$20,999, which brings the total to SG$36,999 after 20 years.

In reality, I received SG$31,976 (with graduation bonus included) after 23 years. This was used to pay for my school fees. That’s a rate of return of 1.68% after 23 years, which is barely beating inflation. It’s difficult to part with the plan as it was bought by my parents for me, but I eventually cancelled it because paying $1.3k/year for a term plan for a sum assured of 100k till in my 50s isn’t worthwhile.

NTUC Star Secure Whole Life Insurance: I got sucked into buying this whole life plan while sorting out my NTUC Foundation Plan. The premiums were SG$3,586/year over 20 years for $100k sum assured. Thankfully, I cancelled before the free look period ended.

What else would I buy if I had more funds?

Should I have additional funds to expand my insurance coverage at my current life stage, I’d like to:

Upgrade my hospital plan: It’s not so much about the fancier hospital beds I would get, but more of the expanded choice of doctors in private hospitals. This means I can seek out doctors with particular expertise, established reputations, or those I trust, rather than being limited to a specific panel or assigned doctors in government hospitals.

Buy disability insurance (DI): DI provides a higher income stream (percentage of your pre-disability income) if you become disabled till you recover (or not at all). It covers scenarios where I might be unable to perform my job due to illnesses or injuries that aren’t classified as a critical illness but still prevent me from earning an income.