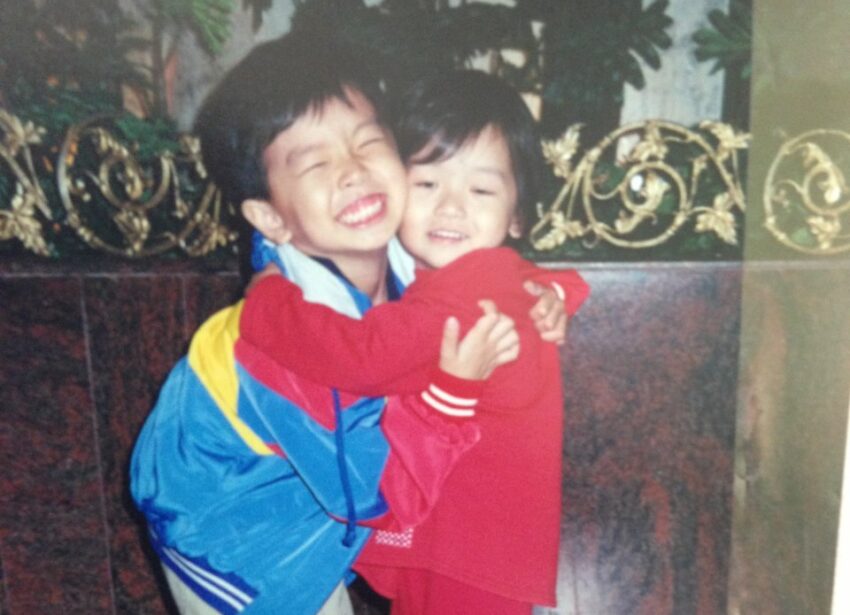

In honour of my brother’s birthday month, let me write a post about him.

My older brother and I are polar opposites of each other. He’s the cheeky one, I’m the shyer and quieter kid. Now, we’re the exact opposite.

When we were younger, he excelled in Math and Science, while I did better in subjects like English and Literature. It’s still the same currently.

Another thing that sharply differed between us: he spent money like it was going out of style, while I hoarded every last penny. Even till today, I meticulously track every dollar, while he finds it a chore.

It’s a question often asked, almost like a personality test.

Why are some people naturally inclined to save, while others find joy in spending?

Invisible hands that shape our money habits

It can’t be upbringing.

We grew up in the same middle-income household with parents who bought us what we needed. While not a luxurious lifestyle, we never truly lacked.

Upon deeper reflection, I concluded it’s simply a personality trait and how we see the world.

The saver’s mindset

Savers like me often operate from an underlying perception of scarcity. We see the world as inherently unpredictable, prone to sudden shifts, and full of potential pitfalls.

Savings create a peace of mind and buffer against life’s inevitable curveballs – an unexpected job loss or a medical emergency.

I have to admit – I can be pretty extreme in saving, fretting over whether to go on that spontaneous day trip with friends or even buy a bottle of water when I’m thirsty.

Sometimes, it’s good to push yourself.

But here’s the trouble: it’s incredibly hard to sustain in the long-term. I realised this isn’t healthy and am risking a far greater deficit: a life rich in numbers but poor in experiences.

It leads to a poverty of experience – experiences that I can only have in my twenties. Always deferring joy, always waiting for “someday” can mean “someday” never truly arrives. I might build an impressive balance sheet, but I’m missing out on the very moments that truly make a life.

The irony is that sometimes, by being too careful with money, you end up being careless with your time and well-being.

The spender’s mindset

Meanwhile, spenders like my brother, conversely, often view the world through a lens of abundance.

They see a continuous flow of resources and the belief that more opportunities will always arise.

For them, money is a tool for living and a vehicle for experiences.

It’s the unforgettable memories created on a spontaneous trip, the enriching skill learned from a new expensive course, the profound satisfaction of treating friends to a meal, or the simple comfort of an air-conditioned home.

Spending can be a powerful way to invest in joy, relationships, and even personal growth right now. It’s about living today, fully and enjoying the present moment.

However, extreme spending, without a mindful thought for tomorrow, is just as dangerous.

It trades immediate gratification for future anxiety, crushing debt, and the complete loss of optionality. It’s like mortgaging tomorrow’s peace for today’s fleeting pleasure, a debt that compounds just as quickly as savings, but in reverse.

The older I get, and the more I observe how people live with money, the more I realise it’s far more nuanced than a simple binary choice.

- Saving buys optionality, spending buys experience. Both have legitimate benefits. Saving offers future flexibility and security, while spending enriches your present life and relationships.

- Both sides of the extremes lead to problems. Unchecked saving can lead to a poverty of experience, while unchecked spending leads to future anxiety and lost optionality.

So, which one is better: being a saver or spender?

Neither, in their purest, unthinking forms. The healthiest approach isn’t to be exclusively one or the other, but to find a balance.

This balance shifts with your life stages and goals.

What’s “enough” savings for security for one person might be seen as excessive by another, and insufficient by a third. What’s a worthwhile “splurge” for one might be seen as frivolous by another.

There is no universal answer, only your personal one.

At my own personal stage of life (working for four years and investing what I believed to be enough), I made a conscious choice to take a pay cut to join Google’s training programme and also went on a digital nomad trip overseas for two months.

These actions somehow remind me that I do have agency in my own life and am not just a mindless NPC in the corporate world.

Money is a tool.

For some, it’s a shield against an unpredictable future. For others, it’s a brush to paint a vibrant present.

The most powerful relationship with money might be the one where you know why you save and why you spend, and whether those reasons align with the life you genuinely want to build.

So, thank you brother for being the vivid splash of color in my carefully structured world, for showing me the beauty of spending on life’s moments, and for helping me realise that true wealth lies not just in what you keep, but in what you consciously choose to experience.